For Private Individuals

Certificates, statements of accounts, cards, loans – order to your Email

Certificates, statements of accounts, cards, loans – order to your Email

Raiffeisen Express transfer – file an application to receive

Raiffeisen Express transfer – file an application to receive

Western Union transfer - file an application to receive

Western Union transfer - file an application to receive

Deposits – activation of automatic replenishment service, early closing

Deposits – activation of automatic replenishment service, early closing

Remote funds transfer to a relative’s account

Remote funds transfer to a relative’s account

Pledged property – free of charge release of movable or immovable property

Pledged property – free of charge release of movable or immovable property

Lease of individual safe deposit boxes – agreement prolongation

Lease of individual safe deposit boxes – agreement prolongation

Closing an account - current/Universal deposit

Closing an account - current/Universal deposit

Change of salary organization - If you change your place of work, we can register you with the new organization online.

Change of salary organization - If you change your place of work, we can register you with the new organization online.

We help with ordered of insurance products:

We help with ordered of insurance products:

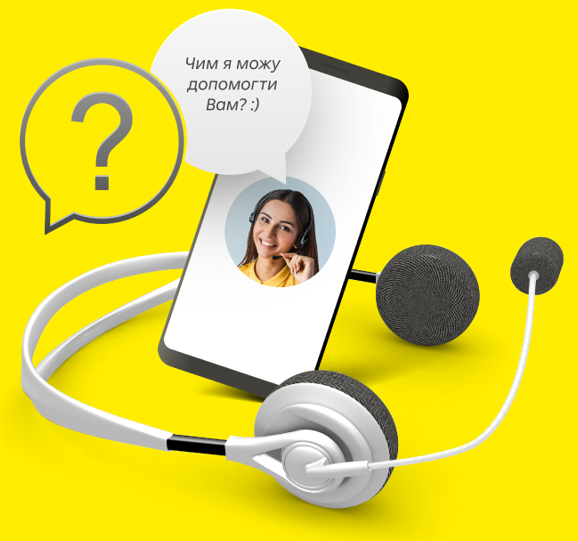

Write to us in the MyRaif app. To do this, go to the application and click on the headset image in the upper right corner of the main screen.

Write to us in the MyRaif app. To do this, go to the application and click on the headset image in the upper right corner of the main screen. 0 800 500 500 (free of charge) For calls from abroad: +38 (044) 044 230 99 98 (at the operator’s tariffs). Details in

0 800 500 500 (free of charge) For calls from abroad: +38 (044) 044 230 99 98 (at the operator’s tariffs). Details in