On the web-site and in MyRaif application.

You can order a card and open the new account remotely*. For this, you need the Diya application with the ID card or international passport.

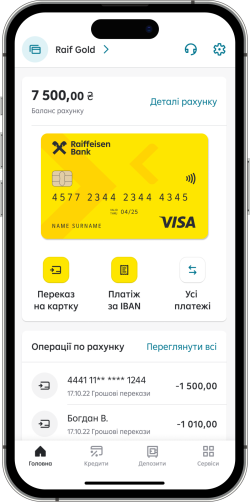

By using this service, you will receive the virtual card which you can use it immediately by adding the card to your Apple Pay or Google Pay mobile wallet.

Additionally, you can order plastic card which will be sent to the bank’s branch of your choice. Term of providing the card is 10 business days from the date of ordering card on the website. To obtain the card must have a passport of citizen of Ukraine or document substituting and help with tax code

At the nearest bank branch.

To order a card you must have a passport of a citizen of Ukraine with you or a document substituting and help with tax code. Card production time - 10 business days from the date of order.

*For client private entrepreneurs the account is opened during business hours.